AISD School Closures 2026: Impact on Austin Home Values & Property Prices

AISD School Consolidations: What History Tells Us About Your Home's Future Austin ISD will close and consolidate schools starting 2026-27, affecting all 116 campuses through closures or boundary changes. With 25,000 empty seats and a $144 million budget shortfall, change is inevitable. Here's what n

Read More

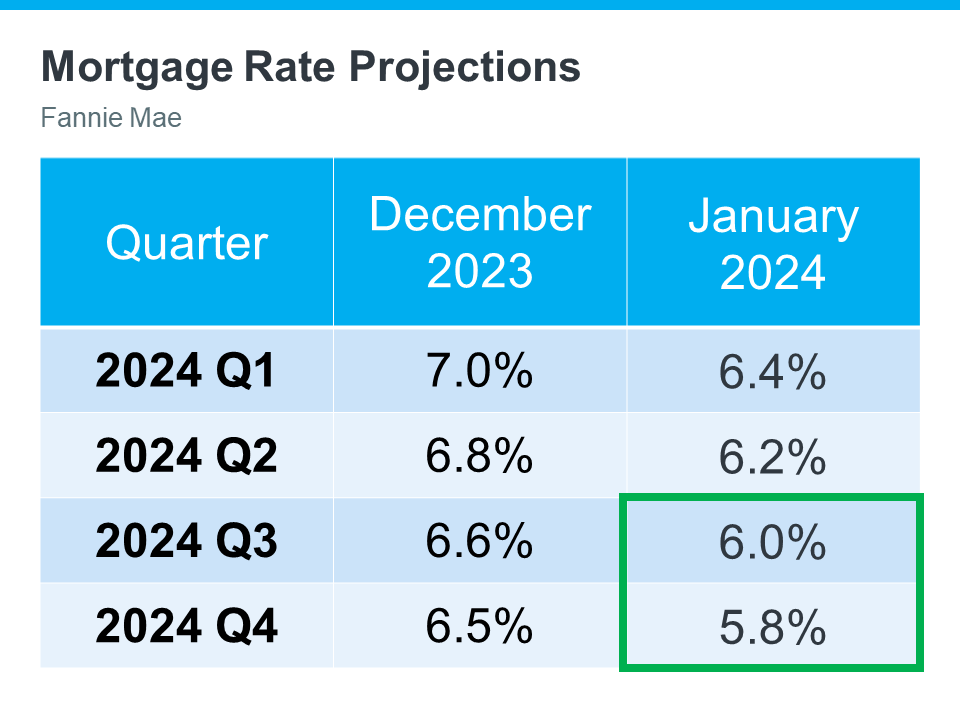

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall. And if you’re looking to buy or sell a home, this is a bi

Read More

Austin's Housing Market Kicks Off 2024 on a High Note

Optimism in the Air The Austin housing market has entered 2024 with a spring in its step, as both buyers and sellers start to feel more hopeful about their prospects. A fresh report from the Austin Board of Realtors paints a picture of a market that's beginning to bounce back, with some encouragi

Read More

January 2024 Central Texas Housing Market Report

January Data Signals Optimism in 2024 for Austin Area Diving into the January 2024 data, there's a wave of optimism sweeping through the Austin area's housing market. The recent report from Unlock MLS has brought some cheerful news: a 4.3% increase in residential home sales, totaling 1,667 closed tr

Read More

January 2024 Real Estate Market Snapshot

Latest Figures (as of February 7, 2024, 2:20 PM): Units Sold: 1,838, a slight decrease of 0.05% from January 2023. Note: This number is subject to change as more sales are recorded in the MLS. Average Sales Price: $526,730, showing a 2.86% decrease compared to last January. Days on Market: Ho

Read More

Categories

Recent Posts