Protect Your Investment: Protest Your Property Taxes Before the May 15th Deadline

At Realty Haus, we're committed to ensuring that our clients are well-equipped to manage their real estate investments wisely. An important opportunity is quickly approaching—the deadline to protest your property taxes is May 15th. Given the changes in real estate values, now is a crucial time to review if your property's assessed value aligns with its current market value. Why Protest Your Property Taxes? Challenging an assessment that seems too high can lead to significant financial savings. Although you can undertake this process yourself, many property owners experience more favorable outcomes when they seek professional help. For those considering this route, we recommend contacting reputable firms that have proven successful in aiding our clients in reducing their property taxes: Five Stone Email: PropertyTax@FiveStoneTax.com Phone: 512.833.5829 Texas ProTax Email: info@texasprotax.com Phone: 512.339.6671 Discount Property Taxes Email: info@discountpropertytaxes.com Phone: 512.467.9852 Tips for a Successful Property Tax Protest: Direct Filing: To increase the likelihood of a favorable review, avoid e-filing your protest and file directly. Documentation: Be sure to refer to code 41.43(a) and have all necessary documentation ready. Filing Strategy: Mark the correct boxes on your protest form, request an evidence packet, and try to file as close to the deadline as possible to ensure thorough consideration. Don't Forget About the Homestead Exemption If you haven’t yet applied for a homestead exemption, doing so could reduce your tax burden for up to two years retroactively. This is an excellent way to save on your taxes moving forward. We at Realty Haus are here to assist and recommend strategies to ensure you are not overpaying your property taxes. Please don’t hesitate to reach out for guidance. We're more than ready to help you navigate this process successfully.

Read MoreNavigating Mortgage Rate Fluctuations: What You Need to Know

If you’re thinking about buying a home, chances are mortgage rates are a big part of your financial planning. You’ve likely heard about their impact on what you can afford each month, and you want to make sure you’re well-informed as you plan your move. Sorting Through the Noise: With all the headlines about mortgage rates recently, it can feel overwhelming trying to make sense of it all. Let’s break down what’s really important for you to know. The Latest on Mortgage Rates: Mortgage rates have been quite volatile lately—bouncing around more than usual. You might be wondering why. The truth is, it’s complex because a multitude of factors influence rates. These include the broader economy and job market, current inflation rates, decisions by the Federal Reserve, among others. Recently, all these elements have contributed to the volatility we're seeing. Odeta Kushi, Deputy Chief Economist at First American, sums it up: “Ongoing inflation deceleration, a slowing economy, and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.” Professionals Can Help: While it's possible to delve deep into each factor affecting mortgage rates, that can be quite time-consuming. When you’re planning a move, you might not want to get bogged down with extensive research. Instead, it’s beneficial to rely on professionals. They're adept at coaching people through market conditions, providing summaries of trends, and interpreting what experts predict for the future, all in terms of how it affects you. Consider this example: a chart showing how changes in mortgage rates might affect your monthly payment when buying a home. If your budget for a monthly payment (principal and interest only) is between $2,500 and $2,600, even a slight shift in rates can significantly impact the loan amount you can afford. Visual Aids Are Key: It’s tools and visuals like these that help translate market dynamics into something meaningful for you. Professionals have the knowledge and expertise to guide you through these tools, making the complex understandable. You Don’t Need to Be an Expert: You don’t need to master every detail about real estate or mortgage rates—that’s what experts are for. Having one by your side can make all the difference. Bottom Line: Curious about the current housing market and how it affects you? Let’s connect. We can help translate what’s happening into practical information that will assist in making informed decisions about your future home purchase.

Read MoreWhy Today’s Housing Supply Is a Sweet Spot for Sellers

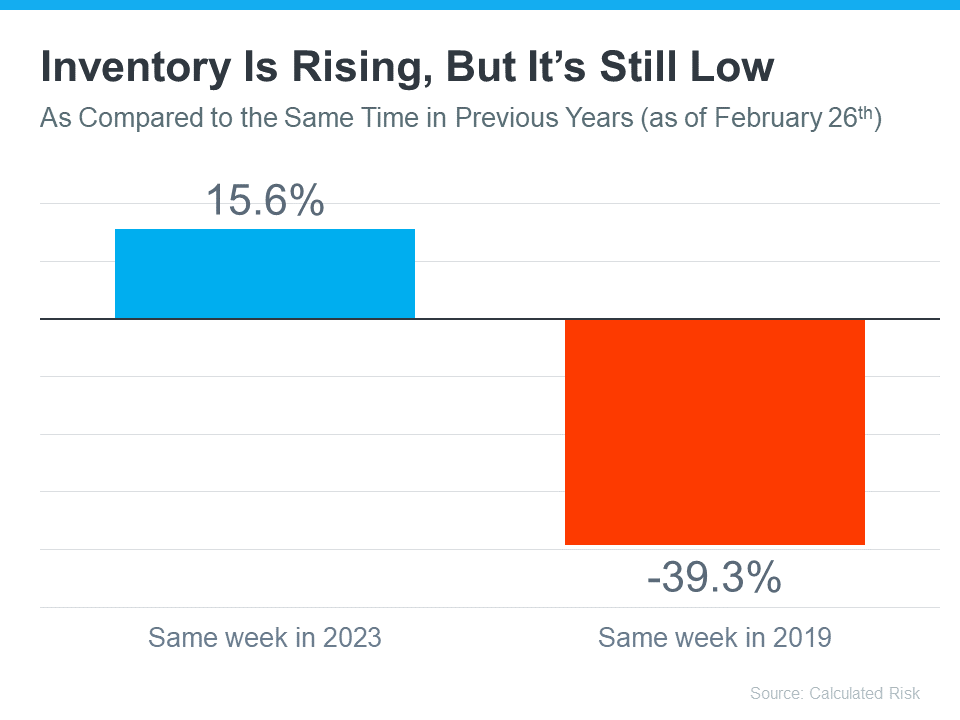

Wondering if it still makes sense to sell your house right now? The short answer is, yes. And if you look at the current number of homes for sale, you’ll see two reasons why. An article from Calculated Risk shows there are 15.6% more homes for sale now compared to the same week last year. That tells us inventory has grown. But going back to 2019, the last normal year in the housing market, there are nearly 40% fewer homes available now: Here’s a breakdown of how this benefits you when you sell. 1. You Have More Options for Your Move Are you thinking about selling because your current house is too big, too small, or because your needs have changed? If so, the year-over-year growth gives you more options for your home search. That means it may be less of a challenge to find what you’re looking for. So, if you were holding off on selling because you were worried you weren’t going to find a home you like, this may be just the good news you needed. Partnering with a local real estate professional can help you make sure you’re up to date on the homes available in your area. 2. You Still Won’t Have Much Competition When You Sell But to put that into perspective, even though there are more homes for sale now, there still aren’t as many as there’d be in a normal year. Remember, the data from Calculated Risk shows we’re down nearly 40% compared to 2019. And that large a deficit won’t be solved overnight. As a recent article from Realtor.com explains: “. . . the number of homes for sale and new listing activity continues to improve compared to last year. However the inventory of homes for sale still has a long journey back to pre-pandemic levels.” For you, that means if you work with an agent to price your house right, it should still get a lot of attention from eager buyers and could sell fast. Bottom Line If you're a homeowner looking to sell, now's a good time. You'll have more options when buying your next home, and there's still not a ton of competition from other sellers. If you’re ready to move, talk to a local real estate agent to get the ball rolling.

Read More

Categories

Recent Posts